Domestic Partner Health Insurance Tax

The tax treatment of employer-provided health coverage for an employees domestic partner or civil union partner depends on whether the domestic partner qualifies as the employees tax dependent for health coverage purposes as defined below. Under federal tax law the portion of an insurance premium that your employer pays for your coverage is not taxed as income.

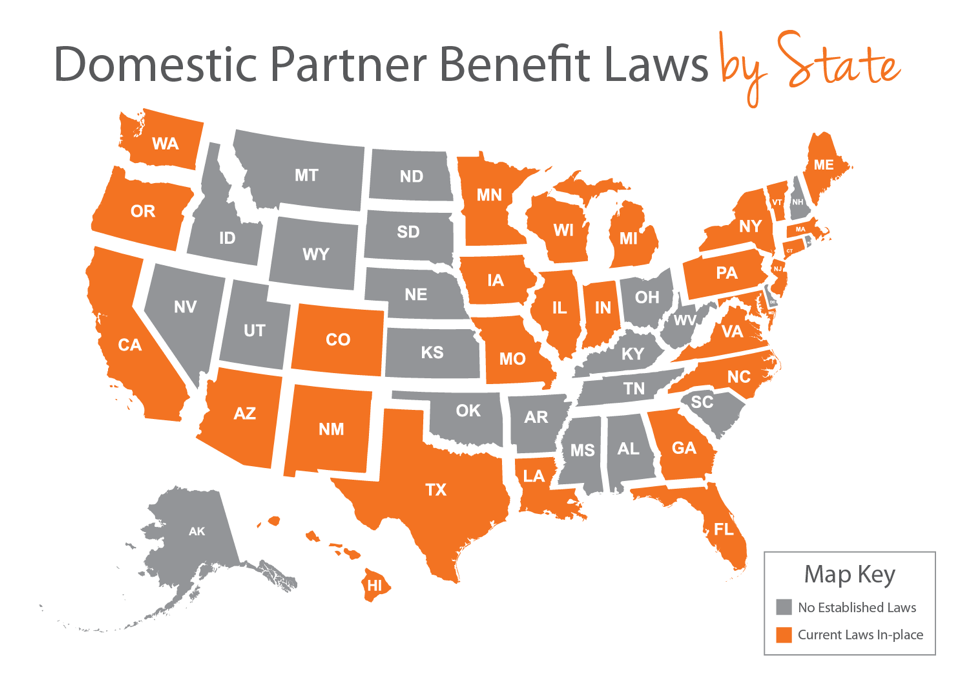

Are Domestic Partner Benefits Mandatory

Federal law treats benefits for spouses children and certain dependents the same way.

Domestic partner health insurance tax. 13 These are not trivial sums. However a domestic partner is not considered a spouse under federal law. Individual Income Tax Return and related schedules and Form 8958 Allocation of Tax Amounts Between Certain Individuals in Community Property State s.

On the federal level an exception is made if the domestic partner meets these three qualifications. Tax DependentAvoids Federal and State Income Taxes. Domestic partners can be of the same or opposite sex.

Federal Tax Treatment of Domestic Partner Health Benefits The federal government does not recognize domestic partnership for tax purposes. 14 The extra cost to the employer can discourage some employers from. Health Insurance for Domestic Partners.

I would like to find out if he can recover this money in his taxes next year. How will the domestic partner benefits be taxed. He is now being taxed nearly 1000month in addition to the 80 we pay for my health insurance.

You may also see your insurance use the term Qualified Domestic Partners QDP. If the domestic partner can also be claimed as a tax dependent on the employees income taxes theyre treated like a spouse. In general when a domestic partner is an employees Code 105 b dependent the domestic partners health coverage and benefits will be tax-free to the employee and the domestic partner.

Imputed Income Calculation based on the portion the company pays. 158806 - 63935 94871 difference in the coverage levels 94871 x 12 1138452 The annual imputed income for adding your domestic partner to the coverage equals 1138452. Registered domestic partners should report wages other income items and deductions according to the instructions to Form 1040 US.

Group Health Plan Special Enrollment Rights. The amount of tax you pay depends on your tax rate. A domestic partner is not considered a spouse under federal tax law but may qualify as a dependent and may be treated accordingly.

The federal tax code allows employees to pay for benefits for themselves their spouses and dependent children using pre-tax dollars. I recently became unemployed so my domestic partner added me to his health insurance plan. Employer contributions to domestic partner health premiums including domestic partner children are counted as taxable imputed income by.

Form PS-4251 Application for enrolling Domestic Partners and Affidavit of Domestic Partnership in the New York State Health Insurance Program NYSHIP with supporting documentation as noted on the form Form PS-4253 NYSHIP Dependent Tax Affidavit Photocopy of your Domestic Partners Birth Certificate Photocopy of your Domestic Partners Social Security Card Photocopy of your Domestic. This is known as imputed income and it will likely affect the employees taxable income and increase the employees tax liability. In 2007 39 percent of nonelderly women were covered through their own.

If your domestic partner qualifies as your tax dependent under Internal Revenue Code 152 as modified by 105 b your domestic partners coverage will be treated in the same manner as a spouse for both federal and state income tax purposes. To qualify as a dependent the domestic partner must live with the employee full-time have gross income of 4300 or less for 2020 and receive more than half of their total financial support from the employee. The term domestic partner is often used in health insurance to describe who may be covered by a family health policy.

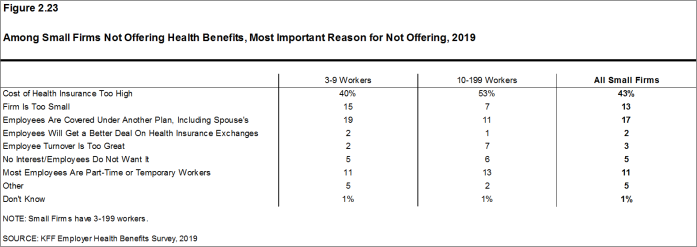

In the United States most women with health insurance are covered through an employer-sponsored health plan. Same Benefits Different Tax Treatment Most nonelderly women and most Americans in general get their health care coverage tax-free from an employer. Domestic partner taxation benefits are perhaps the biggest challenge employers face in offering this coverage.

12 This means that if the employer pays 500 a month toward health coverage for a domestic partner the 6000 in extra income will cost the employer 459 extra in payroll taxes and it will cost the employee assuming an income tax marginal rate of 35 a total of 2 559 extra in taxes. Both people arent related by blood that would disqualify a marriage in a state For tax purposes only your portion of the health insurance costs paid by your employer is income tax-free. If a covered domestic partner is not considered a tax dependent under federal law the employer must include the fair market value of the health insurance benefits provided to the domestic partner in the employees gross income.

Domestic Partner Insurance Can Be Tax-Free Its possible for employer-paid insurance coverage to be tax-free in certain circumstances. For insurance domestic partners must be a couple.

The Advantages Of Hiring A Personal Injury Lawyer Http Krasneylaw Net Blog The Advantages Of Hiring A Persona Medical Billing Health Insurance Humor Medical

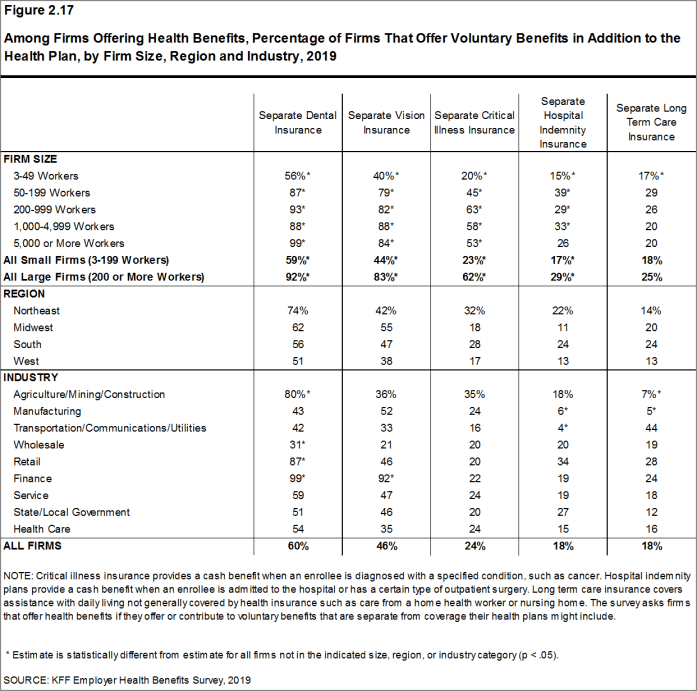

Section 2 Health Benefits Offer Rates 9335 Kff

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

Registered Domestic Partners And Company Defined Domestic Partners Abd Insurance And Financial Services

All Top Insurance Company Mydukaan Online Insurance Insurance Company Best Insurance

What To Do If You Missed The Deadline To Get Health Insurance Health Insurance Coverage Medical Insurance Health Insurance

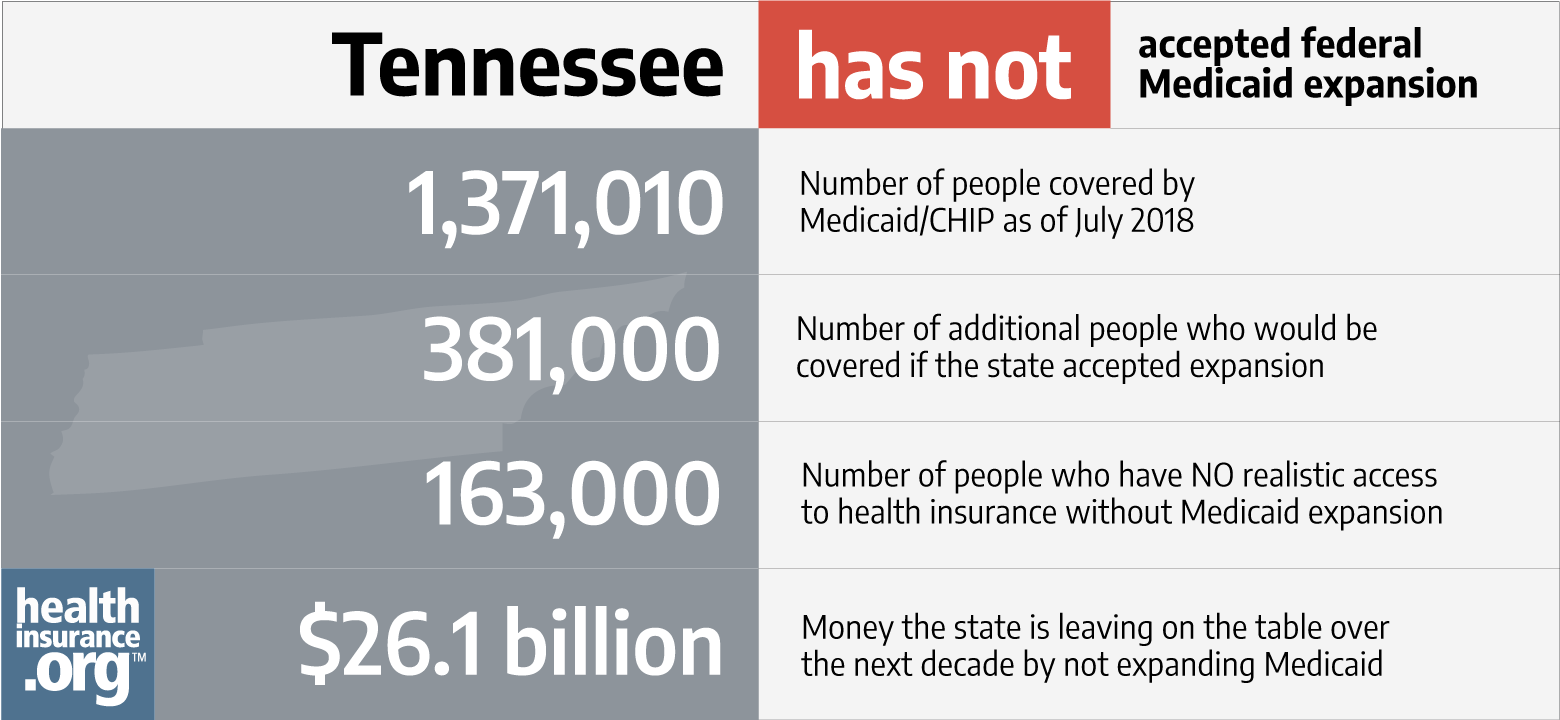

Tennessee And The Aca S Medicaid Expansion Healthinsurance Org

Save Your Tax By Buying Religare Health Insurance Health Insurance Health Check Health Insurance Plans

How To Switch To Your Spouse S Health Insurance Policy Midyear

Domestic Partner Health Insurance Do You Qualify Alliance Health

Section 2 Health Benefits Offer Rates 9335 Kff

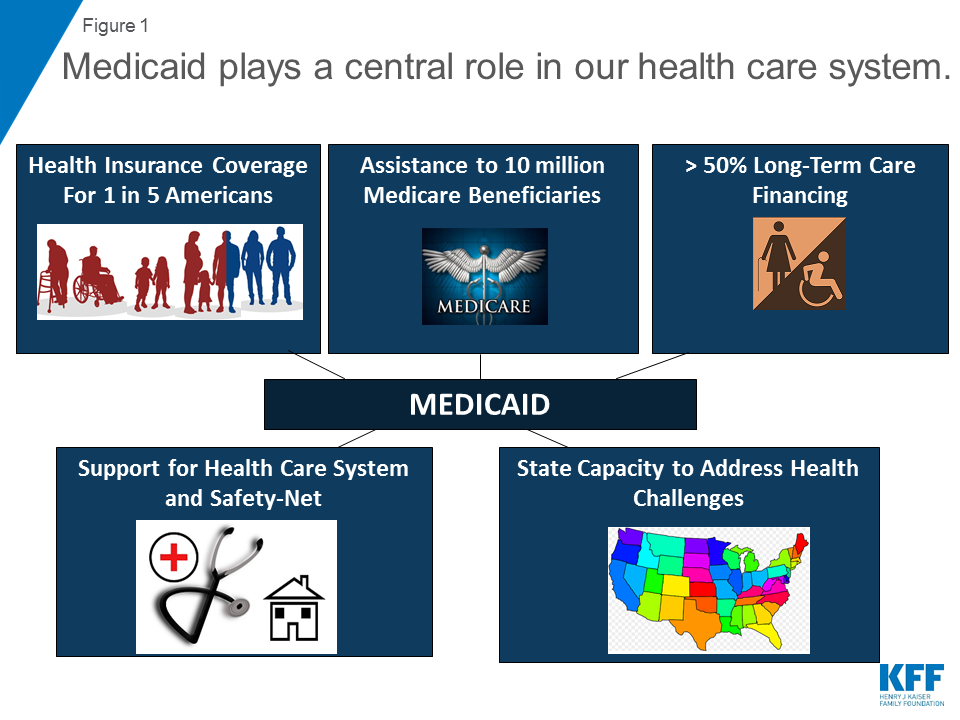

10 Things To Know About Medicaid Setting The Facts Straight Kff

What Is 2 Shareholder Health Insurance Definition Benefits

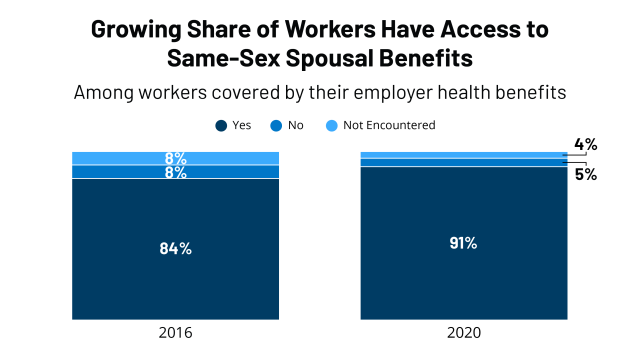

Access To Employer Sponsored Health Coverage For Same Sex Spouses 2020 Update Kff

Average Health Insurance Cost For Married Couples Lively

Employers Domestic Partnerships And The Irs Lumity

Religare Health Insurance Save Money Health Insurance Health Insurance Plans Best Health Insurance

How To Choose Health Insurance Policy Health Insurance Benefits Types Of Health Insurance Health Insurance

Post a Comment for "Domestic Partner Health Insurance Tax"